2020 has been a year of growth for MarketBeat. Our email list has grown by more than 500,000 subscribers since the first of the year. We brought on two additional employees. We just crossed $10 million in revenue for the year and expect to see 75% year-over-year growth for the year. While we did see a bump in website traffic during the early stage of the COVID-19 epidemic, most of our growth can be credited to improved strategy and execution. In this post, I want to share five growth strategies that MarketBeat has been able to leverage this year to continue growing.

2020 has been a year of growth for MarketBeat. Our email list has grown by more than 500,000 subscribers since the first of the year. We brought on two additional employees. We just crossed $10 million in revenue for the year and expect to see 75% year-over-year growth for the year. While we did see a bump in website traffic during the early stage of the COVID-19 epidemic, most of our growth can be credited to improved strategy and execution. In this post, I want to share five growth strategies that MarketBeat has been able to leverage this year to continue growing.

- Hiring People Smarter than Yourself

This is the year where I finally admitted that I do not know everything when it comes to MarketBeat. I am not the best person at negotiating advertising deals or buying advertising for MarketBeat. I do not have the best understanding of MarketBeat’s technical infrastructure. There are growth opportunities that my team identifies that I miss because I am not paying attention to the right things. I’ve intentionally put myself in charge of fewer things this year and empowered my team to do the things they are best at without me getting in the way.

We also made a very strategic hire this year by bringing Dave Parkinson on as MarketBeat’s chief strategy officer and giving him the opportunity to buy equity into MarketBeat. I met Dave six years ago at a conference called Rhodium Weekend, and we have kept in contact and done business periodically ever since. Dave has been an official employee for about six months, but he has already created a ton of value for the company, including a change to our opt-in forms that is getting MarketBeat 5,000 additional mobile opt-ins each month. It’s very freeing to know that there is another person thinking around the clock about how to grow your business as much as you are.

- Attracting More Eyeballs with Horizontal Expansion

Our team recently made a strategic decision to start creating other complimentary financial brands in addition to MarketBeat. Since most of our subscribers receive multiple financial newsletters each day, we think there is a growth opportunity by our company being two or three of the newsletters that people subscribe to instead of just one. Each additional brand that we create gives us a broader footprint in the Google Search results, provides the opportunity to create new social media profiles and lets us experiment with new strategies on smaller brands before launching them on MarketBeat.

Our team recently made a strategic decision to start creating other complimentary financial brands in addition to MarketBeat. Since most of our subscribers receive multiple financial newsletters each day, we think there is a growth opportunity by our company being two or three of the newsletters that people subscribe to instead of just one. Each additional brand that we create gives us a broader footprint in the Google Search results, provides the opportunity to create new social media profiles and lets us experiment with new strategies on smaller brands before launching them on MarketBeat.

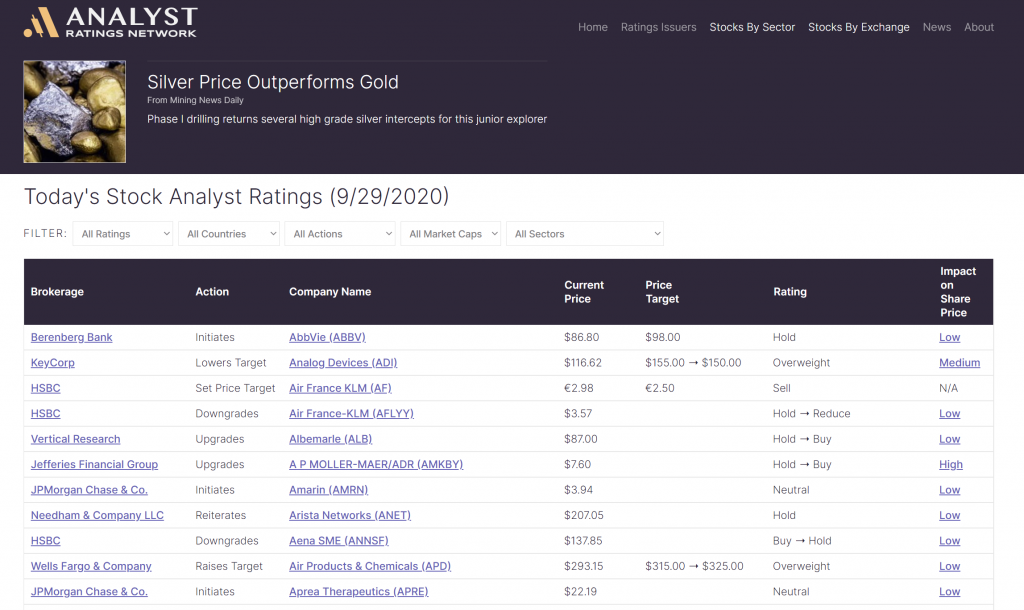

The first major new brand that we launched is a 7:00 AM newsletter called The Early Bird. We started it about 18 months ago, but really figured out how to make profitable this year. Since it is sent out hours before our other newsletters each day, The Early Bird and MarketBeat’s Newsletter don’t really compete with each other for attention. We are currently launching a second new brand called Analyst Ratings Network, which was actually the name of our company until we adopted the MarketBeat name in 2015. The Analyst Ratings Network website will focus on stock analyst recommendations exclusively and eventually have a branded newsletter that ties into it. Finally, we have plans to launch websites about dividend investing and insider transactions in 2021.

- Abandoning Traditional Display Advertising

When most people put advertisements on their website, they are given a snippet of code to put on their website from an advertising platform such as Google AdSense, Media.Net, MediaVine or AdThrive and they have no control over what advertisements appear on their website or what they get paid to display them. It is a somewhat opaque process and there can often be two or three layers of companies in between the advertiser or the publisher that are all taking a cut. For example, we found out that there were affiliate partners of Agora (a major financial newsletter publisher) that were buying advertisements on our website through Google AdSense. This means both Google and the affiliate were making money by putting Agora ads on our website, which does not make any sense because MarketBeat has a direct advertising relationship with Agora.

We decided to go against all industry best practices, drop every traditional ad network from our website and build our own ad server. We then reached out to the advertisers that we work with the most often and invited them to test our new display advertising solution. We also tied into existing advertising inventory that we had access to from companies that pay us on a performance basis to promote their products. Creating our own solution also gives us more flexibility to design ads that work within our website, only show the most relevant advertisements to our audience and have ads that don’t look like every other advertisement online.

The results have been astonishing. We are seeing $30.00 page RPMs (revenue per 1,000 pageviews), which is more than double what a similar website would expect to earn from a more traditional advertising network. Display advertising is the fastest area of growth for MarketBeat and we expect to see a 200% increase in display advertising revenue in 2020 compared to 2019.

- Email List Cross-Pollination

MarketBeat publishes five different newsletters: MarketBeat CryptoBeat, MarketBeat Daily Ratings, MarketBeat Dividend Advisor, MarketBeat Insider Trades and The Early Bird. Our users can be subscribed to just one newsletter or all five, and sometimes they are not signed up for the newsletters that are most closely aligned with their interests. For example, if someone has AT&T, Exxon Mobil, Walgreens, or other high-dividend blue-chip stocks in their MarketBeat portfolio, they are most likely interested in dividend stocks. If we see someone is following numerous dividend stocks in their portfolio but are not already receiving the MarketBeat Dividend Advisor newsletter, we’ll sign them up for it automatically.

We call this list cross-pollination. We take our existing subscribers that have already opted-in to receiving our content and dynamically updating their mailing preferences and matching what newsletters they receive based on the interests we know about them. Since we can track what pages users visit on our website, what stocks they follow and what ads they click on, we have a pretty good understanding if someone is interested in cryptocurrencies, options trading, gold, or any number of other investing topics. We’ve setup our mailing list software to automatically add people to the appropriate newsletter if their interest score on a given topic goes above a certain threshold.

List cross-pollination has made it so that our most active users receive more email from us, which means they engage with our brand more often, click on more advertisements, and generate more revenue for the company.

- Increasing Advertising Spend

For the last several years, MarketBeat has bought about $100,000 per month worth of advertising from a handful of sources that we know work well for us. I am a big believer that every business should reinvest 20-30% of revenue back into marketing and advertising. Since MarketBeat’s top-line revenue was growing this year, our advertising spend needed to grow too. Unfortunately, we were capped out on our existing channels and had to identify new paid channels to be able to grow our spend.

My philosophy on advertising is that the more targeted of a campaign you can do, the better the likely outcome will be. For us, this means only advertising to people that have money in the stock market or are on a website about the stock market. We started by reaching out to the websites that we got best results with and asked them if there were other types of advertising we could buy from them that we had very good results on. We try to break even in about 90 days on any advertising that we do, and any revenue generated by users after that is pure profit.

We also started doing some media buying through Google Adwords, Bing Ads, Dianomi, and Verizon Media. If you were to Google MarketBeat, you might actually see a MarketBeat ad. It’s too early to tell if these campaigns will be a big source of growth in the future, but they are really the only way to buy advertising at scale online.

Wrap-up

While most of these strategies may not be directly applicable to your business, hopefully there is a nugget of knowledge that you can apply to your work. What’s worked well to help grow your business this year? Let me know in the comments below or send me an email at matt [at] mattpaulson [dot] com.